It has been an interesting year so far and the punches keep coming. This is what it must feel like if you stepped in the ring with Mike Tyson. Soon enough you would find yourself with a broken jaw, black eye, chewed off left ear, half a nose, and possibly a missing pinky toe.

The most recent uppercut is the election of the first African-American President of the United Sates of America , Barack Obama, by the American people. November 4, 2008 will be etched into history books and millions of school children will be forced to memorize the date as the day America ‘Changed’. Enough on politics, lets take a closer look at what the markets think of all this.

For reasons that I don’t quite understand, and I am not sure I am interested enough to find out, Republicans are commonly referred to as Elephants and Democrats as Donkeys. What I am interested in however, is seeing how the markets reacted to these Donkeys and Elephants over time.

I used the following indexes to represent different segments of the market:

- S&P 500: Large corporates

- NASDAQ: Tech industry

[I wanted to include other indexes but it was getting too complicated. Plus, Office 2007 kept crashing on me]

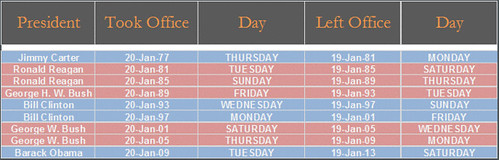

The table below is a summary of each US President and the respective terms served. All data used is from Jan 20, 1977 – Nov 7, 2008.

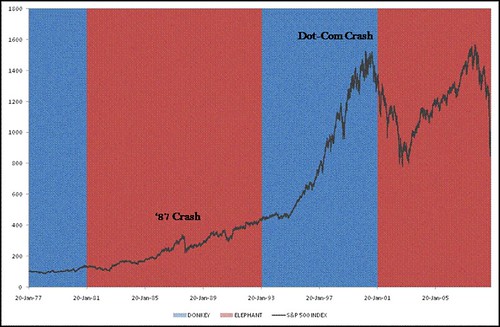

Market reaction: S&P 500 Index [Bloomberg: SPX Index]

The chart below shows the S&P 500 shaded to represent the Donkey [blue] or Elephant [red] that was living in the White House at the time.

Source: Bloomberg. Daily closing price. 1977 - 2008. Al-Hamour

To be able to understand the market’s reaction to each President’s term I have included a ranking that takes the annualized return for each term served. So, because Bill Clinton served for two terms he will have two entries.

![S&P 500 Ranking [1 term] Source: Bloomberg. Al-Hamour](http://farm4.static.flickr.com/3140/3016007413_b2d8a03df8.jpg?v=0)

Source: Bloomberg. Al-Hamour

![S&P 500 Ranking [2 term] Source: Bloomberg. Al-Hamour](http://farm4.static.flickr.com/3235/3016840224_557aa35bd7.jpg?v=0)

Source: Bloomberg. Al-Hamour

- During Bill Clinton’s single and overall terms the S&P 500 performed the best on an annualized basis @ 9.91%

- The Elephant [George W. Bush] has the worst record relative to his peers

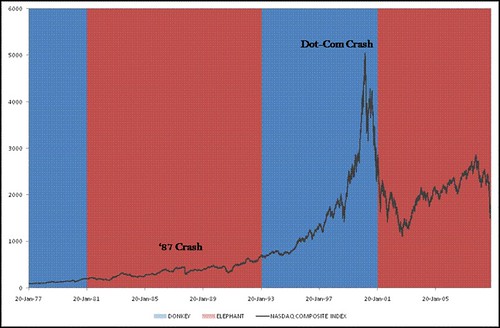

Market reaction: NASDAQ COMPOSITE Index [Bloomberg: CCMP Index]

The chart below shows the NASDAQ daily price close, shaded to represent the Donkey [blue] or Elephant [red] that was living in the White House at the time.

Source: Bloomberg. Al-Hamour

To be able to understand the market’s reaction to each President’s term I have included a ranking that takes the annualized return for each term served. So, because Ronald Reagan served for two terms he will have two entries.

![NASDAQ Ranking [1 term] Source: Bloomberg. Al-Hamour](http://farm4.static.flickr.com/3214/3016007897_619eb9ba8a.jpg?v=0)

Source: Bloomberg. Al-Hamour

![NASDAQ Ranking [2 term] Source: Bloomberg. Al-Hamour](http://farm4.static.flickr.com/3231/3016840430_d4ac5e3e11.jpg?v=0)

Source: Bloomberg. Al-Hamour

- During Jimmy Carter’s term the NASDAQ performed the best on an annualized basis

- The Elephant [George W. Bush] has the worst record relative to his peers

Lessons learned:

- Donkeys ranked number one for both the S&P 500 and NASDAQ

- George W. Bush is the worst Elephant and overall President

What to expect:

Despite the current banking and financial crisis we would expect that President-elect Barack Obama follow in the footsteps of the Donkeys before him. He has a tough road ahead of him and will have to address key issues such as rising unemployment, failing financial institutions, and the US dependency on oil exports. I suggest he attend Bill Clinton’s speech hosted by the National Bank of Kuwait [Bloomberg: NBK.KK Equity] next Sunday the 16th of November. Maybe he can pick up a few pointers. I know I will be there.

I haven’t read any articles analyzing the U.S. markets according to elephants or donkeys’ ruling periods. Interesting subject and very well presented.

It will be nice if you can update us on the key issues mentioned in the speech 🙂

Regardless which party is in power, history repeated itself. Japan infamous past crisis happening all over in the US.

Back then there was no globalization and the YEN isn’t the major world currency. Moreover, a lot of people were insulated due to the restrictive Japanese culture.

The US have now created Zombie banks and slowly extending into Zombie corporates (GM would be the biggest Zombie ever created if bailed out).

Global assets are all correlated with the US and expenditures all over the world targeted the US consumer who’s equity equals a BIG MINUS.

Even after the exponential growth of the FED balance sheet, the Global Stagnation is unavoidable.

Inflation causes wars, but deflation and depression lead to revolutions.

Indeed, all this is being pulled off to create such result be prepared Chavez, Najad, Putin and Hu Jintao. Internal army spending will bleed your economies to death.

You read it here first, on the Hamour’s blog. The Guru has spoken!

OT

Why is the British Pound falling so hard against the Dinar? I’m making Christmas vacation plans and London at this rate is way cheaper than Dubai! 1 KD gets you £2.5 Sterling! What gives?

Thanks

@Nubo

KWD/USD rate hasnt changed much, but the pound to the US dropped big time so you get this huge decline in Pound vs KD.

The British economy is underwater, recession, huge job cuts and Zombie banks.

Money is flowing out of the UK fast and to make matters worse their Guilts (Gov. Bonds) aren’t being bought ( reminds me of their initial empire collapse and Sorros all over again)

Huge interest rate cuts and more to come.

The pound needs to be low to attract capital inflows and stimulate manufacturing demand.