I received a phone call last Thursday morning around 10:40 am informing me that all trading on the Kuwait Stock Exchange [KSE] has been suspended. Here is what the press reported:

Lawyer Adel al-Abdul Hadi says the Administrative Court in Kuwait City ruled on Thursday that all trading be halted. The order takes effect immediately and is to last until next court hearing on November 17 [1]

At first I was not sure of the story and I kept getting different answers so I decided to focus on the event itself and not the details of what happened. What is confirmed is the parties involved are a lawyer[s], Kuwaiti Courts, and the KSE. This is what I imagine happened:

المØامي: اÙÙÙÙ ! كل يوم Øد أدنى! كل اللي أشوÙÙ‡ Ø£Øمر! ليش الØكومة الكويتية ما تسوي شي؟

يدخل الÙراش كعادته الساعة الØادية عشرة صباØا وبيده استكانة الشاي مع الدرابيل

الÙراش: سنو Ùيه بابا، ليش زعلان؟

المØامي: هذا السوق، تدري اشكثر خسران؟

الÙراش: سنو يعني؟ كم Ùلوس يبي بابا؟ أنا يعطيك

!المØامي: لو تشتغل 100 سنة معاشك ما يغطي ربع الخساير

الÙراش: أنا يقول ØÙ‚ انتا سنو يسوي.. هادا ÙÙŠ كراتشي سوق كل يوم ينزل. ناس Ù†Ùر Ø±ÙˆØ Ø³ÙˆÙŠ “بروتست” ØÙ‚ Øكومة مال باكستان، Øكومة وق٠سوق

المØامي: ها؟ والله يطلع منك! انزين Ø±ÙˆØ ÙŠÙŠØ¨Ù„ÙŠ بعد درابيل

Lawyer: Damn it! Its limit down every day! I see is red! Why isn’t the Kuwaiti government doing anything about this?

Tea Boy enters with red chai and darabeel [2] as he usual does at 11:00 every morning

Tea Boy: What’s wrong Baba. Why are you upset?

Lawyer: This market, you know how much I have lost?!

Tea Boy: What does that mean? How much money do you need, I’ll give you.

Lawyer: If you work for 100 years, your salary won’t cover a quarter of my losses!

Tea Boy: Let me tell you what to do. In Karachi, the market was down every day. People went to ‘protest’ and the government stopped the trading.

Lawyer: Huh? Well you do have some good ideas. Now go get me more darabeel.

The rest is history.

If anyone has a copy of the court ruling please email me a copy and I will post it

To be fair, stock markets do close when extraordinary situations prevail. An example would be 9/11 when the American stock markets were closed from September 11 – 14, 2001. However, it was a decision made by the government not for the government by a lawyer.

What actions should be taken

I believe that if there are people that are willing to spend the time and effort improving the public markets and investment community they should be addressing the following.

Issue: Liquidity

Objective: Liquidity is the lubricant the market needs in order for it’s internal gears to function smoothly. In addition, liquidity also provides forced sellers a means to exit their positions in order to fulfill their obligations.

Proposed Solution:

- Market makers: In a free market operation, a buyer will always seek a seller and vice-versa. At times, we find that there is a large gap between buyer and sellers in a market due to liquidity constraints. Market makers are in the business of ensuring liquidity is available to whomever needs in by always making a bid [buyer] and offer [seller]. Instead of the Kuwaiti government merely injecting cash into the market, I suggest they establish a KD 150-200 mm Market Maker fund. The government would appoint various investment companies, that meet the criteria, to become market makers using these funds. The company would benefit by being able to generate income on the spread and the government will address the issue of liquidity, a win-win situation.

Issue: Regulation

Objective: To ensure that a conflict of interest does not exist between the financial market regulator and an exchange operator.

Proposed Solution:

- FSA model: London’s Financial Services Authority is a good example to follow as an independent non-government body with a wide range of rule-making, investigatory and enforcement powers in order to meet their objective. The FSA has no relation to the exchanges which operate in England and are accountable to the Parliament. [3]

- Private Bourse: Kuwait should allow the establishment of private bourses or exchanges. Not only does this improve efficiency through competition, but it also enables greater access to market participants for companies that currently do not meet listing requirements. However, this is not limited to equity exchanges as we should also develop exchanges to trade credit [bonds & sukuks] , commodities, and other financial instruments.

Issue: Transparency

Objective: Stockholders should always have the right to access company information as they are owners in the businesses they invest in. Management should not try and deceive shareholders and are expected to provide accurate and non-misleading information.

Proposed Solution:

- Frequent investor communication:Â A simple way o ensure that stockholders are aware of the company’s activities is by holding events where the management discusses such issues. In addition to the annual report and general assembly, companies should have more frequent communication with investors and analysts covering the stock. This ensures that decision makers are equipped with the necessary information in order to make decisions as the whether to buy, sell, or hold. I suggest that companies have quarterly analyst and investor calls/meetings that discuss the financial statements produced.

Issue: Competence

Objective: Te ensure professionals managing and advising client assets are qualified to do so.

Proposed Solution:

- Regulation of investment professionals: Kuwait must develop licenses for investment professional who are managing or advising client assets. The General Securities Representative license [Series 7] is one example of the requirements needed in the US for a professional to communicate with retail investors, among other things. It is essential that we establish such guidelines and licenses in order to ensure that qualified and competent people are managing our money.

Obviously these suggestions are not the be-all and end-all of what needs to be done. However, I believe they tackle the most important issues we are faced with today. I am confident that if we focused our time and effort in trying to address these issues and implement the proposed solutions rather than having silly protests, we will be one step closer in establishing a more sophisticated financial community.

[1] The Associated Press. November 13, 2008.

[2] Darabeel: Arabic sweets

[3] Financial Servies Authority

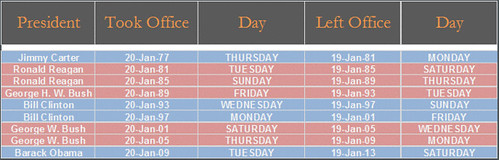

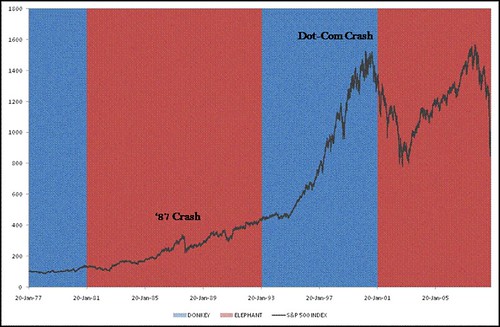

![S&P 500 Ranking [1 term] Source: Bloomberg. Al-Hamour](http://farm4.static.flickr.com/3140/3016007413_b2d8a03df8.jpg?v=0)

![S&P 500 Ranking [2 term] Source: Bloomberg. Al-Hamour](http://farm4.static.flickr.com/3235/3016840224_557aa35bd7.jpg?v=0)

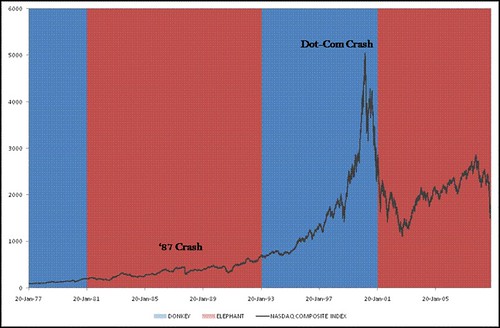

![NASDAQ Ranking [1 term] Source: Bloomberg. Al-Hamour](http://farm4.static.flickr.com/3214/3016007897_619eb9ba8a.jpg?v=0)

![NASDAQ Ranking [2 term] Source: Bloomberg. Al-Hamour](http://farm4.static.flickr.com/3231/3016840430_d4ac5e3e11.jpg?v=0)